Real Estate Crowdfunding: Opportunities and Risks

Introduction to Real Estate Crowdfunding

Real estate crowdfunding has revolutionized the way people invest in property. By allowing individuals to pool their resources, it offers an accessible avenue for both seasoned and novice investors to diversify their portfolios. But like all investments, it comes with its own set of opportunities and risks. Understanding these can help you make informed decisions and maximize potential returns.

What is Real Estate Crowdfunding?

Real estate crowdfunding is a method of raising capital for real estate investments by soliciting small amounts of money from a large number of people, typically through online platforms. Investors can choose from a variety of projects, ranging from residential properties to commercial developments, and earn returns based on the project’s success. This form of investment democratizes real estate, allowing more people to participate in opportunities that were once reserved for the wealthy.

How Does Real Estate Crowdfunding Work?

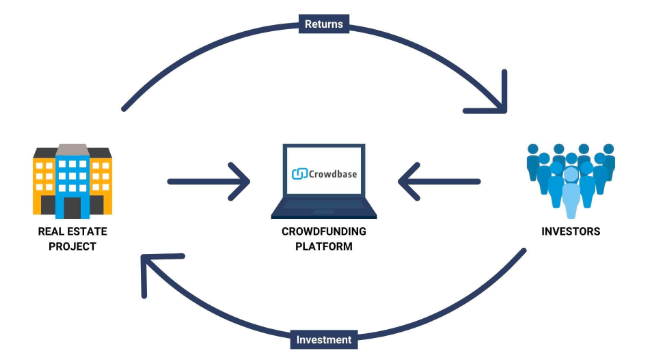

Crowdfunding platforms act as intermediaries between investors and real estate developers. Developers list their projects on these platforms, providing details about the investment, including potential returns, risks, and timelines. Investors then choose the projects they want to back, contributing funds in exchange for a share of the profits. Once the project is completed or sold, investors receive their returns, typically in the form of rental income, interest, or profits from the sale.

Types of Real Estate Crowdfunding

There are two main types of real estate crowdfunding: equity and debt. In equity crowdfunding, investors purchase a share of the property, and their returns come from rental income and property appreciation. Debt crowdfunding, on the other hand, involves lending money to a real estate project in exchange for fixed interest payments. Both types come with their own sets of risks and rewards, and investors should carefully consider which aligns better with their financial goals.

Advantages of Real Estate Crowdfunding

Real estate crowdfunding offers several benefits, making it an attractive option for many investors.

Accessibility and Affordability

One of the most significant advantages of real estate crowdfunding is its accessibility. Unlike traditional real estate investments, which often require significant capital, crowdfunding allows individuals to invest with much smaller amounts. This affordability opens up real estate investment to a broader audience, including those who may not have the means to purchase property outright.

Portfolio Diversification

Investing in real estate through crowdfunding also provides an opportunity to diversify one’s portfolio. By spreading investments across multiple properties and regions, investors can reduce their risk exposure. Diversification is a key strategy in managing investment risk, and real estate crowdfunding offers an easy way to achieve it.

Passive Income

Real estate crowdfunding can generate passive income for investors. Whether through rental income, interest payments, or profits from property sales, these investments can provide a steady stream of income without the need for active management. This is particularly appealing for those looking to supplement their regular income or build wealth over time.

Potential for High Returns

Real estate has historically provided solid returns, and crowdfunding allows investors to tap into this potential. While returns can vary depending on the project and market conditions, successful investments can yield substantial profits. This potential for high returns is one of the main reasons investors are drawn to real estate crowdfunding.

Transparency and Control

Crowdfunding platforms typically offer detailed information about each project, including financial projections, risk assessments, and progress updates. This transparency allows investors to make informed decisions and monitor their investments closely. Additionally, investors have the flexibility to choose projects that align with their risk tolerance and investment goals.

Risks Associated with Real Estate Crowdfunding

Despite its many advantages, real estate crowdfunding is not without risks. It’s essential to understand these risks before committing funds.

Market Risk

Like all real estate investments, crowdfunding is subject to market risk. Property values can fluctuate due to changes in the economy, interest rates, and other factors. If the market takes a downturn, the value of the investment may decrease, leading to lower returns or even losses. Investors need to be aware of these market dynamics and consider them when making investment decisions.

Liquidity Risk

Real estate investments are inherently illiquid, meaning they cannot be easily converted into cash. In crowdfunding, this illiquidity is compounded by the fact that investments are often locked in for several years until the project is completed or sold. If an investor needs to access their money before the project concludes, they may face difficulties in doing so, potentially resulting in financial strain.

Default Risk

There’s also the risk that the developer or borrower may default on their obligations, particularly in debt crowdfunding. If the project fails or the developer runs into financial difficulties, investors may not receive the expected returns or may lose their principal investment entirely. This default risk is something investors should carefully evaluate before committing funds.

Platform Risk

Since real estate crowdfunding is conducted through online platforms, there’s a risk associated with the platform itself. If the platform fails, investors may lose access to their funds or encounter delays in receiving returns. It’s crucial to choose reputable platforms with a proven track record to mitigate this risk.

Regulatory Risk

Real estate crowdfunding is subject to regulatory changes that could impact its operation. For example, changes in securities laws or tax regulations could affect the viability of certain investments or alter the returns investors receive. Staying informed about regulatory developments is essential for managing this risk.

Read also: What are the main judging criteria in barrel racing competitions?

Limited Control

Unlike direct real estate investments, where investors have control over property management and decisions, crowdfunding investors have limited control over the project. Decisions are typically made by the developer or platform, leaving investors with little influence over the outcome. This lack of control can be a drawback for those who prefer a more hands-on approach.

Evaluating Real Estate Crowdfunding Opportunities

Before investing in real estate crowdfunding, it’s essential to evaluate the opportunities carefully. This involves assessing both the project and the platform.

Researching the Platform

The first step in evaluating a real estate crowdfunding opportunity is researching the platform. Look for platforms with a strong track record, transparent operations, and positive reviews from other investors. It’s also important to check the platform’s fee structure, as fees can significantly impact your returns.

Analyzing the Project

Once you’ve chosen a platform, the next step is to analyze the specific project. Review the details provided, including the location, type of property, projected returns, and timeline. Consider the developer’s experience and track record, as well as the market conditions in the area. A thorough analysis can help you identify the projects with the highest potential for success.

Understanding the Investment Structure

Different crowdfunding projects have different investment structures, such as equity or debt. Understanding the structure is crucial, as it determines how returns are generated and the level of risk involved. For example, equity investments may offer higher returns but come with greater risk, while debt investments provide more stable returns but may offer lower yields.

Assessing the Risks

Every investment comes with risks, and real estate crowdfunding is no exception. Assess the risks associated with the project, including market risk, default risk, and liquidity risk. Consider how these risks align with your investment goals and risk tolerance. A careful risk assessment can help you make more informed decisions and avoid potential pitfalls.

The Role of Due Diligence

Due diligence is a critical component of real estate crowdfunding. This process involves thoroughly researching the project, the developer, and the platform to ensure that the investment is sound. Due diligence can help you identify potential red flags and avoid projects that may not deliver the expected returns.

Diversifying Your Real Estate Crowdfunding Portfolio

Diversification is a key strategy in managing investment risk, and real estate crowdfunding is no different. By spreading your investments across multiple projects, regions, and property types, you can reduce your exposure to any single risk. This diversification can help stabilize your returns and protect your portfolio from market fluctuations.

The Future of Real Estate Crowdfunding

Real estate crowdfunding is a relatively new industry, but it has grown rapidly in recent years. As more investors and developers embrace this model, the industry is likely to continue evolving.

Technological Advancements

Technology plays a significant role in the growth of real estate crowdfunding. Advances in online platforms, data analytics, and blockchain technology are making it easier for investors to access opportunities and manage their investments. These technological advancements are likely to drive further innovation in the industry, offering new ways for investors to participate in real estate projects.

Regulatory Changes

As real estate crowdfunding grows, it will likely face increased regulatory scrutiny. While regulation can provide investor protection, it may also impose new challenges for platforms and developers. Staying informed about regulatory changes is crucial for investors to navigate this evolving landscape.

Increased Accessibility

The future of real estate crowdfunding may see even greater accessibility for investors. As platforms become more user-friendly and offer a wider range of investment options, more people may be drawn to this form of investment. This increased accessibility could democratize real estate investment even further, making it an option for an even broader audience.

FAQs

How much money do I need to start investing in real estate crowdfunding?

The minimum investment amount varies by platform, but many allow you to start with as little as $500 or $1,000. This low entry point makes real estate crowdfunding accessible to a wide range of investors.

Is real estate crowdfunding a good investment?

Real estate crowdfunding can be a good investment, but it depends on your financial goals and risk tolerance. It offers the potential for high returns, but it also comes with risks that should be carefully considered.

What are the tax implications of real estate crowdfunding?

The tax implications of real estate crowdfunding depend on the investment structure and your location. Returns from equity investments may be subject to capital gains tax, while interest from debt investments could be taxed as ordinary income. It’s advisable to consult with a tax professional to understand your specific situation.

Can I exit my investment early in real estate crowdfunding?

Exiting a real estate crowdfunding investment early can be challenging due to the illiquid nature of real estate. Some platforms may offer a secondary market for selling your shares, but this is not always available, and you may have to wait until the project is completed to access your funds.

How do I choose the right crowdfunding platform?

When choosing a real estate crowdfunding platform, consider factors such as the platform’s track record, fee structure, transparency, and the types of projects it offers. Researching and comparing different platforms can help you find one that aligns with your investment goals.

What happens if a real estate crowdfunding project fails?

If a project fails, the outcome depends on the investment structure. In equity crowdfunding, investors may lose their principal investment if the property is sold at a loss. In debt crowdfunding, the lender may foreclose on the property to recover funds, but there is still a risk of loss. It’s important to understand the risks involved and choose projects carefully.

Conclusion

Real estate crowdfunding offers a unique opportunity for investors to access the lucrative real estate market with relatively low capital. However, it is not without risks, and careful consideration must be given to the platform, project, and overall market conditions. By understanding both the opportunities and risks, conducting thorough due diligence, and diversifying investments, investors can make informed decisions that align with their financial goals. As the industry continues to evolve, staying informed and adaptable will be key to successfully navigating the world of real estate crowdfunding.